Analyzing XAUUSD and Future Price Predictions

- Paid 4 Trade

- May 27, 2025

- 4 min read

As the global economy adapts to ongoing changes and geopolitical events stir uncertainty, the quest for safe-haven assets becomes increasingly important for investors. Gold, represented by the XAUUSD trading pair, is a key player in this search. Recent market conditions favor a bullish trend for gold, potentially unlocking significant returns for traders. Our clients here have gained over 300% ROI in the last 48 hours alone. This post explores the current XAUUSD trends and speculates on future price movements.

Understanding the Current Market Conditions

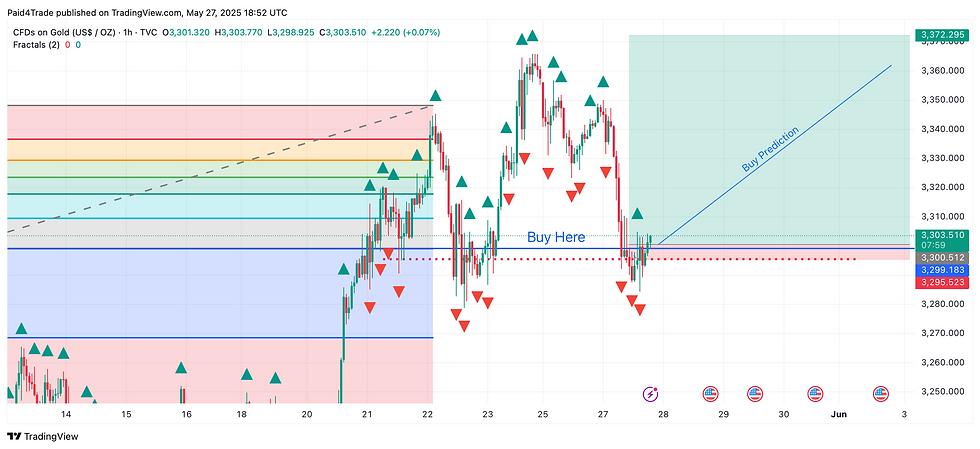

The global economic landscape is influenced by a variety of factors, including inflation rates, geopolitical tensions, and shifts in monetary policy. Gold is often viewed as a safe haven during uncertain times, and its current trading level of $3,300.00 for XAUUSD reflects prevailing market sentiments and economic indicators that imply a potentially bullish trend ahead. In light of our proprietary model utilizing the “P4T” indicators, we would like to share our positive outlook for XAUUSD. We anticipate that the price may reach $3,340.00 within the coming week. This expectation is supported by a recent bullish engulfing candle formed at the 4-hour support level near $3,296, which suggests a strong reversal and the possibility of a rally to a new all-time high, aligning with our analysis.

Gold has proven itself as a resilient asset during periods of economic turbulence. Several factors contribute to its steady demand:

High Inflation Rates: Global inflation rates, which reached a five-decade high at about 9.1% in 2022 in the U.S. alone, are compelling central banks to reconsider monetary policies. Investing in gold becomes an attractive option as it often retains value during inflationary times.

Interest Rates and Currency Fluctuations: Lowering interest rates can weaken the dollar and make gold more appealing. With the Federal Reserve and other central banks adopting dovish monetary policies, a weaker dollar enhances gold’s attractiveness. For instance, a 1% drop in the dollar index typically correlates with a 2-3% increase in gold prices.

As we evaluate these factors, it’s clear that they paint a favorable outlook for XAUUSD in the near future.

The Role of Geopolitical Tensions

Geopolitical factors continue to add volatility and affect gold market dynamics. Ongoing regional conflicts or political unrest often heighten demand for gold, as investors seek safety in uncertain times.

For example, in 2024, during the Russia-Ukraine conflict, gold prices surged by more than 40% as investors flocked to this precious metal for security amid geopolitical unrest. Each escalation in conflicts tends to push gold prices higher, creating an opportunity for investors to capitalize on these market fluctuations.

Future Price Predictions for XAUUSD

With the data derived from our P4T tools and current market dynamics, we foresee XAUUSD potentially reaching new heights in the upcoming months. The immediate target of $3340.00 represents a short-term opportunity that traders can capitalize on. Beyond that, we are optimistic about surpassing the previous all-time high of $3442.00, as historical trends suggest persistent upward momentum whenever such bullish patterns emerge.

The analysis has taken into account various indicators, including market volumes, sentiment analysis, and historical price action, resulting in a robust forecast. Therefore, we highly encourage traders to consider placing buy options on XAUUSD as we believe this could lead to significant profits.

Moving Averages: A recent "golden cross," where the 50-day moving average has crossed above the 200-day moving average, indicates potential bullish momentum. Historically, this signals an upward trajectory, significantly boosting traders' confidence in taking long positions.

Relative Strength Index (RSI): The RSI has hovered around 60, indicating that the market is not yet overbought. An RSI below 70 suggests there is still room for further gains, and this trend can be significant for continued price appreciation.

Overall, the prevailing sentiment leans positively as traders anticipate favorable conditions for XAUUSD going forward.

Strategies for Trading XAUUSD

For those ready to seize the opportunity within the current bullish trend, here are some effective trading strategies:

Buy/Long Positions: Given the bullish indicators, taking Buy/Long positions on XAUUSD aligns with expectations of price growth. If the outlook remains strong, this approach could yield substantial returns.

Diversifying Portfolios: Integrating gold as part of a diversified investment strategy can hedge against risks from volatility in other asset classes. Studies show that a portfolio with 10-15% gold exposure can enhance returns during uncertain economic times.

Traders should also remain agile and informed about ever-changing market conditions while adjusting their strategies to maximize potential returns.

Final Thoughts on XAUUSD Trends

In summary, the analysis of XAUUSD indicates a favorable bullish trend driven by supportive market conditions, robust technical indicators, and geopolitical influences. With the backdrop of rising inflation, a weak dollar, and increased global uncertainty, there are valuable opportunities for traders.

At Paid 4 Trade, we prioritize not only the potential for profit but also the importance of sound risk management. As with any trading decision, it is essential to employ strategies that can mitigate risks and protect your capital. Always assess your risk tolerance and consider setting stop-loss orders to safeguard your investments.

As we embark on this trading journey, we wish all our readers the best of luck. May your trades be fruitful, and may your strategies yield the results you seek. Remember, the market rewards those who are informed and prepared.

Comments